It would be impossible to accurately predict where the LED lighting industry is going in the next few years without first looking back at the unprecedented period of disruption we’ve just experienced (and, in some ways, are still going through).

When we gathered four leading LED industry insiders for a lighting retrofit roundtable during Retrofit Showcase 2021 (a virtual conference this May sponsored by SnapCount), the official topic of conversation was what lies ahead for the rest of 2021 and beyond.

And as it turns out, there’s reason for optimism.

Our panelists are already seeing surging demand for LED lighting projects and a general sense of positivity among lighting retrofit professionals.

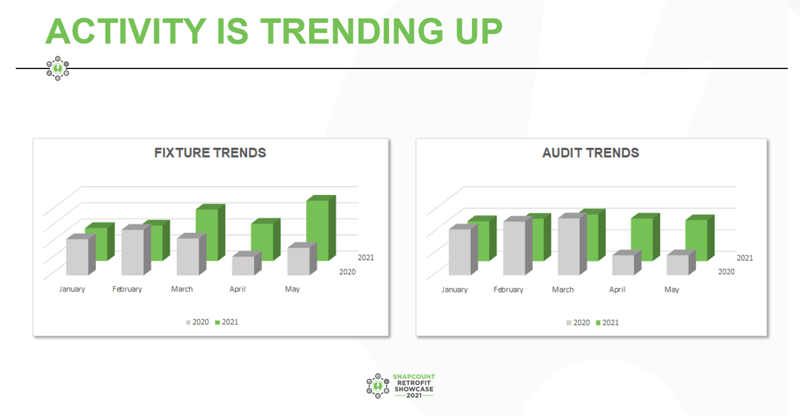

This bright outlook aligns with the data we’ve accumulated and analyzed here at StreamLinx.

A graph we shared at Retrofit Showcase 2021 (see below) shows a 200% increase in audits conducted throughout the SnapCount network year-over-year between April 2020 and April 2021. Fixture installation data tells a similar story.

With these two positive LED industry trends in mind, let’s turn it over to the experts. Our illustrious panel comprised four retrofitting veterans: Joe Scarbrough of EiKO Global, Brad Picht of Graybar Electric, Navi Salaria of EnerSavings, and Julia Dolsen of Shiffler Equipment Sales.

With these two positive LED industry trends in mind, let’s turn it over to the experts. Our illustrious panel comprised four retrofitting veterans: Joe Scarbrough of EiKO Global, Brad Picht of Graybar Electric, Navi Salaria of EnerSavings, and Julia Dolsen of Shiffler Equipment Sales.

Here are some key insights from the 2021 Retrofit Roundtable:

Things Are Looking Up in the LED Lighting Industry

Our panel of experts did not shy away from acknowledging how challenging the past year has been.

For example, Julia Dolsen’s company, Shiffler Equipment Sales, focuses on schools. Shiffler’s contractors were asked to vacate school buildings along with students and teachers when the pandemic hit.

Now, though, school business is back in a big way. Not only are schools looking to finish projects they started before the pandemic, but they’re investing government stimulus funds on new projects.

“We have some schools calling us a bit in a panic saying, ‘Hey, I have some money that I need to spend by June 30. Can we do that?” Dolsen said.

From his business development position with LED lighting manufacturer EiKO Global, Joe Scarbrough has a high-level view of retrofit activity across the U.S. He saw several large-scale projects get put on pause in 2020. Now those projects, and others like them, are underway again.

“The volume of opportunities that we’re seeing is increasing every day,” said Scarbrough.

Navi Salaria represents the Canadian firm EnerSavings. EnerSavings didn’t let the pandemic slow down the company’s exponential growth.

“Last year was really good for us,” said Salaria. “I guess the secret recipe that we have is our team...They know this industry.”

Salaria went on to explain that EnerSavings strives to keep all four of its “buckets” full: the pipeline, leads, audits and proposals. By focusing on essential industries such as manufacturing, food processing and transportation, the team at EnerSavings grew its business at the height of the pandemic. This year, it has been conducting 25 to 30 audits per week.

Brad Picht of Graybar Electric noted another reason sales are picking up again:

“We have outside salespeople that are just now getting to a point where they can go back and actually visit their customers. It makes it very difficult to do a lot of the type of renovation business that we do without actually being there in person...We are very reliant upon those projects where we can have an influence and be a part of it. We’re not just quoting a bill of material.”

Despite the Optimism, Progress Is Slow

Supply chain issues are plaguing businesses in every field around the globe, and the LED industry is no different. Scarborough revealed that before the pandemic, the average lead time for receiving products from Asia was around 90 to 100 days. Now, it’s 150 days.

“Rail is a big issue now,” said Scarborough. “We used to account for two to three days. Now, we’re adding 25 to 28 days for rail delivery.”

Lines of ships are waiting to unload at ports because there aren’t enough truck drivers available to transport the freight, added Picht, saying, “I do think that there’s going to be ongoing issues and problems with freight,” he said. In fact, every manufacturer Picht has dealt with recently has said high transportation costs are driving price increases.

Scarbrough predicts that lead times — and perhaps shipping costs — will return to the pre-pandemic level by the end of this year. Manufacturers like EiKO Global are working overtime to compensate for the supply chain slowdown.

“March and April were the worst of it for us suppliers because it’s during that time that we did not anticipate problems,” he said. “And now… I was on a call this morning, and in the past week and a half, we’ve landed 36 containers. We added another warehouse and increased capacity to hold more product.”

Retrofitters are seeing slowdowns not only on the supply side but from customers, as well. Salaria said that his company’s average sales cycle from the first presentation was about 90 days last year. Lately, it’s been stretching to 160 days or more.

“There are not that many people out there who are willing to spend money at this time,” he said. “They just want to wait.”

Picht has observed a similar industry trend. The biggest problem right now, he said, is “getting the customer to actually go out and do something.”

“Everybody is ready to talk about doing something, but I don’t know that there’s always that many people that are ready to pull the trigger,” Picht said. “Commercial construction is a great example of that. How many people are actually going back to the office, and how many are going to stay at home? That's going to set a position where there's a glut of office buildings that are out there — and they're either going to sit empty, or they're going to have to find some new way to repurpose those.”

Controls Are Becoming Standard Thanks to Their Ease of Use

No conversation about LED industry trends would be complete without touching on technology. We asked our panelists to share with us some of their most in-demand offerings.

Dolsen said that there has been a noticeable shift to “selectable” products.

“Troffers, downlights, wall packs — those are big items for us,” she explained. “And we’ve seen this shift starting in 2019 – and it’s gotten even stronger now – where you have one product on the shelf, and you can select in the field what color temp you want, and on some of them, even the wattage. Coupled with dimming, that has really reduced the number of SKUs from manufacturers, which means they’ve stocked up on panels in general.”

Most LED fixtures are dim-ready now, and control switches are coming down in cost. “Dimming and basic control are definitely key items that aren’t even an upsell anymore,” added Dolsen.

If you had asked Scarborough 18 months ago, he would have estimated that 20% of the projects his company sold included sensor controls.

“These days, it’s around 65%,” Scarbrough said. “It’s really becoming the norm very quickly.”

Controls have become more popular because they’re easier to use, Picht observed. Not too long ago, dimming systems were elaborate and confusing, he said.

“That’s one of the things that I would say is really where I’m seeing some added value being brought to the customer,” Picht said. “The controls are really more usable today than they have been in the past.”

Retrofitters who want to diversify can even expand beyond controls, added Salaria:

“If we talk about new trends, consider IoT solutions. Controls have been around for a while now and there's no significant price increase if we add simple controls to the existing fixtures. But when it comes to IoT, I think that's where the price increases by at least 20, 25%, sometimes 30%, depending on how complex the customer wants to go. I’m optimistic that IoT is where the market is going, but that increased cost will get customers asking about payback and ROI – so that’s the challenge we need to be prepared for.”

What else did our panel of experts have to say about the latest LED industry trends, emerging LED technology, and the business impact of COVID-19? Watch the full hourlong roundtable here.

Share this post: